Tổng số bài đăng 471.

The implemented public investment could continue to rise in response to the National Assembly's fiscal stimulus package.

According to the General Statistics Office (GSO), the implemented public investment in March 2022 jumped 7.5% yoy to VND 29.1 trillion (versus an increase of 14.9% yoy seen in the previous month). For 1Q22, disbursed state capital rose 10.6% yoy to VND76.3tr (below the 14.5% rate seen in 1Q21), equivalent to 14.4% of the full-year target.

At the extraordinary session of the 15th National Assembly, the Government submitted to the National Assembly for approval a fiscal stimulus package worth VND350,000 billion to stimulate socio-economic recovery and development in 2022–2023, 42% of which should be disbursed this year.

Thus, apart from the disbursement in the 2021–2025 medium-term public investment plan, the Government would disburse another VND103,000 trillion for expressway construction projects, road projects connecting to gateways, seaports, and industrial zones. The disbursement of investment capital from the state budget was estimated at VND46.3 trillion (10.4% YoY) in the first two months of this year, with VND20,517 trillion (9.9% YoY) in February alone.

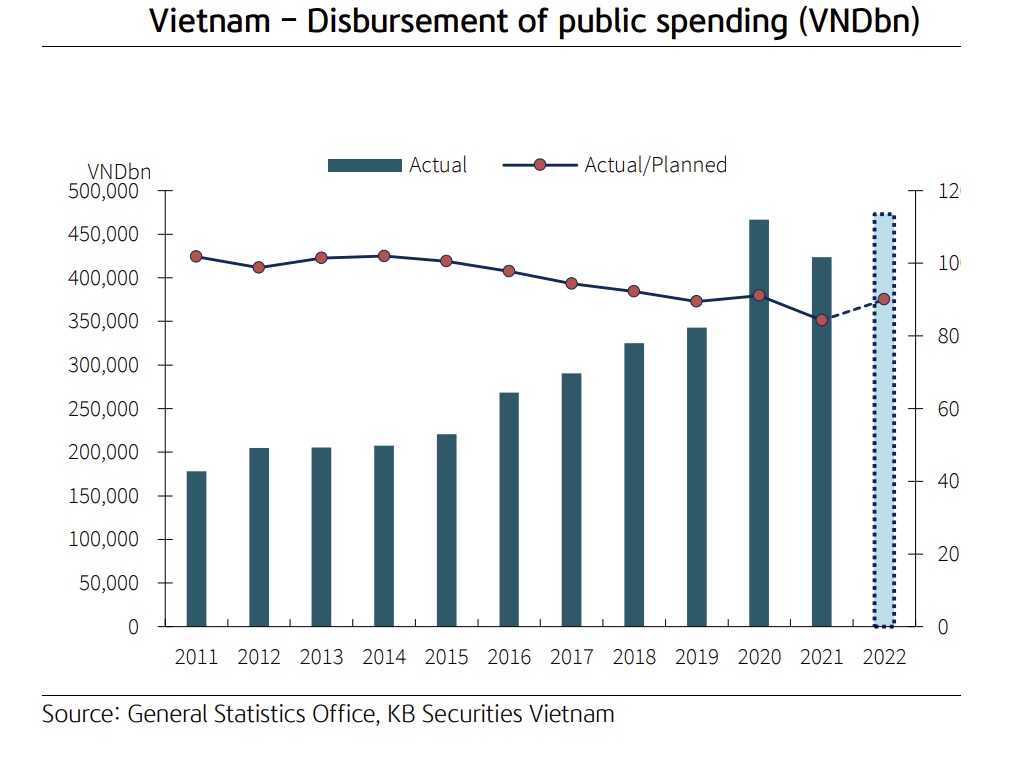

With the government's high determination and drastic measures combined with positive macro factors, Mr. Dinh Quang Hinh, VNDirect analyst, believes public spending will be promoted this year from the 2021 low following the economic reopening. In 2022, he estimates a total disbursement of VND473 trillion (11.7% YoY, fulfilling 90% of the plan).

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, also expects public investment to accelerate in the coming months as the public investment package under the new economic package starts to be deployed in April 2022. It is known that the infrastructure investment package (under the economic stimulus package) is worth about VND113,050bn, and the Government expects to disburse 50% of this package in 2022.

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, also expects public investment to accelerate in the coming months as the public investment package under the new economic package starts to be deployed in April 2022. It is known that the infrastructure investment package (under the economic stimulus package) is worth about VND113,050bn, and the Government expects to disburse 50% of this package in 2022.

However, Mr. Tran Duc Anh noted that the implementation of public investment projects also faces a downside risk in the near future if the price of construction materials such as steel, cement, and construction stone remains high due to the impact of the Russia-Ukraine conflict and supply chain disruption. Contractors may delay the projects as planned due to the rising cost of construction materials, which has negatively impacted the profit margins of construction enterprises.

"For 2022F, we maintain our forecast that the implemented state capital will increase by 20% compared to that in 2021, as GDP growth in the second half of 2022 could pick up from the low base of the same period in 2021. It is noted that, public investment grew negatively in the last six months of 2021 due to the 4th wave of the COVID-19 pandemic, social distancing, and rising construction material prices", Mr. Tran Duc Anh said.

Mr. Dinh Quang Hinh said some sectors and businesses would benefit from public spending in 2022, such as infrastructure and construction enterprises, especially ones experienced in public investment projects, namely CIENCO4 Group (C4G), Vietnam Construction and Import-Export (VCG), Licogi 16 (LCG); companies with electronic toll collection (ETC) & smart traffic control systems like Electronics Communications Technology Investment Development (ELC), Innovative Technology Development (ITD); Businesses in residential real estate that own large landbanks near key projects such as Vinhomes (VHM), Khang Dien House Trading and Investment (KDH), Nam Long Group (NLG), Dat Xanh Group (DXG); Industrial real estate companies like Viglacera Corporation (VGC), Kinh Bac City Development (KBC), Phuoc Hoa Rubber (PHR), Nam Tan Uyen JSC (NTC), IDICO Corporation (IDC); and building materials enterprises like Hoa Phat Group (HPG), Hoa An JSC (DHA).

Source: Business Forum Magazine