Tổng số bài đăng 465.

UOB (Singapore) ASEAN Consumer Sentiment Study 2024 was conducted through consumer surveys in Singapore, Malaysia, Thailand, Indonesia and Viet Nam.

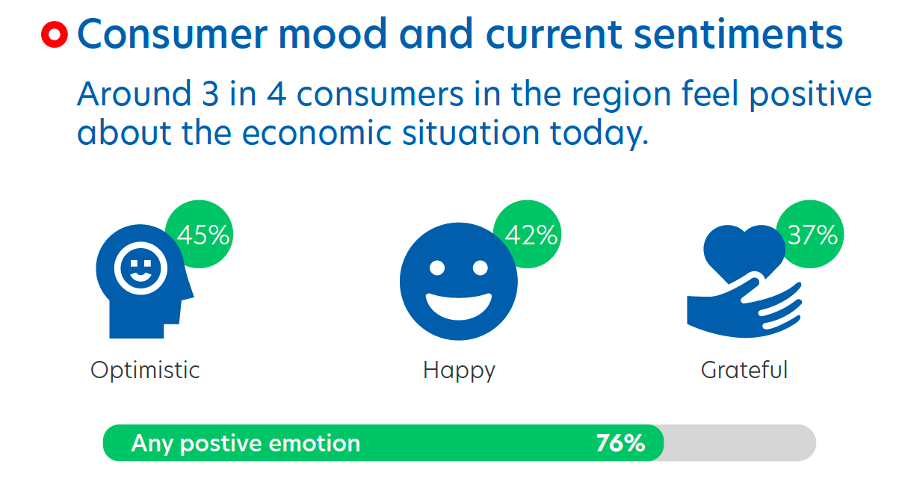

Similar to last year, positivity permeates the region in the context of today’s economic situation. The majority of respondents (76 per cent) reported feeling mostly positive emotions, with the top three positive emotions felt being optimistic (45 per cent), happy (42 per cent) and grateful (37 per cent).

Indonesian and Vietnamese respondents were the most positive in the region with 84 per cent experiencing positive emotions, surpassing Singapore (77 per cent), Thailand (71 per cent) and Malaysia (63 per cent). In terms of demographics, Gen Y (79 per cent), Affluent (81 per cent) and Male (78 per cent) segments experienced more positive moods than others in the region.

However, finances are a top concern across the region, particularly in Malaysia (85 per cent) and Thailand (80 per cent). Rising inflation (63 per cent) and increased household expenses (58 per cent) are the primary causes for concern.

A decline in savings and long-term financial commitments are concerning for those in Malaysia (62 per cent) and Thailand (58 per cent), more so now than before.

Purse strings are tightening in response to rising prices

Due to rising costs of living, consumer spending has gone up across the region. Utilities (21 per cent), child education (17 per cent), and groceries (10 per cent) are the top three categories where spending has increased.

Budget allocation for expenses is also higher than before at 34 per cent – a 10-percentage point increase from 2023. Fewer consumers are putting money into savings (32 per cent, down 3 percentage points compared to the previous year’s study), perhaps due to rising prices.

In response to financial worries, many across the region are tightening their purse strings. More than half (52 per cent) of consumers said they spent less on non-essentials, particularly those in Malaysia (60 per cent). Others actively sought offers and discounts while shopping, especially those in Indonesia (52 per cent) and Malaysia (54 per cent).

More consumers are using digital resources to monitor and build their wealth (61 per cent across the region, three percentage points higher than the previous study), especially among the Gen Z.

ASEAN spending habits

In terms of cross-border spending, two in three consumers in the region have spent money overseas, mainly on leisure and business travel purposes. Across all spending categories, including overseas bank transfers and overseas investments, Singapore, Thailand and Malaysia are the top ASEAN markets where regional spending has taken place.

Upon a closer look, 50 per cent of regional leisure spending was recorded in Singapore, contributed heavily by Indonesian (79 per cent) and Thai (68 per cent) consumers. When it comes to business trips, Singapore is also the preferred destination (63 per cent) for overseas expenditure.

Among those who have spent overseas, 62 per cent of respondents prefer paying by physical or mobile credit/debit cards.

Consumers display a strong savings mindset

Savings continues to be a priority in the region, with two in five saving more than 20 per cent of their monthly income. Specifically, 54 per cent have set aside at least three months’ worth of expenses as their emergency fund. This habit is prominent, particularly in Singapore, where 60 per cent of respondents save at least three months’ worth of expenses. Across ASEAN, about 70 per cent have a fair to very good idea on the amount they would need to retire comfortably.

Among the generations, the youth (Gen Z and Gen Y) and Affluent display a strong savings mindset with around three in four saving more than 10 per cent of their monthly income. Malaysia notably lags behind other markets when it comes to savings, with most consumers (30 per cent) saving around 10 per cent or less of their monthly income and 6 per cent not saving at all.

Source: UOB