Tổng số bài đăng 471.

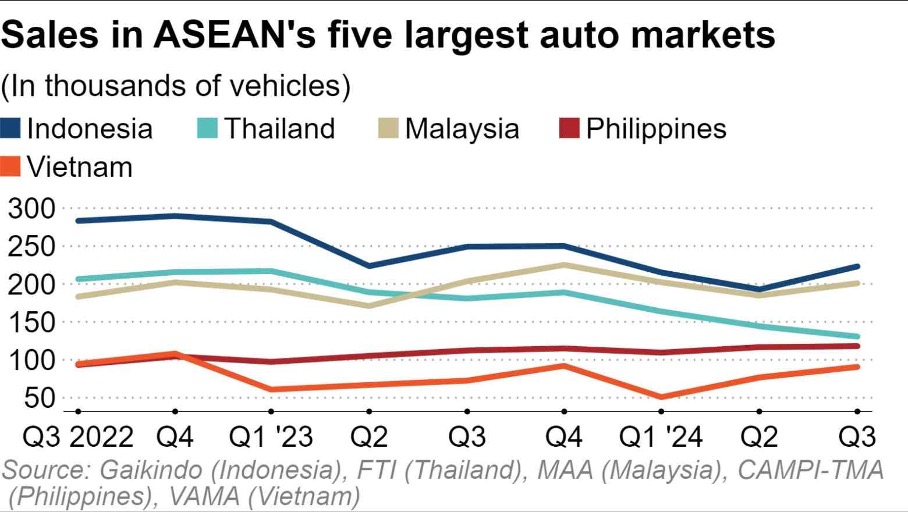

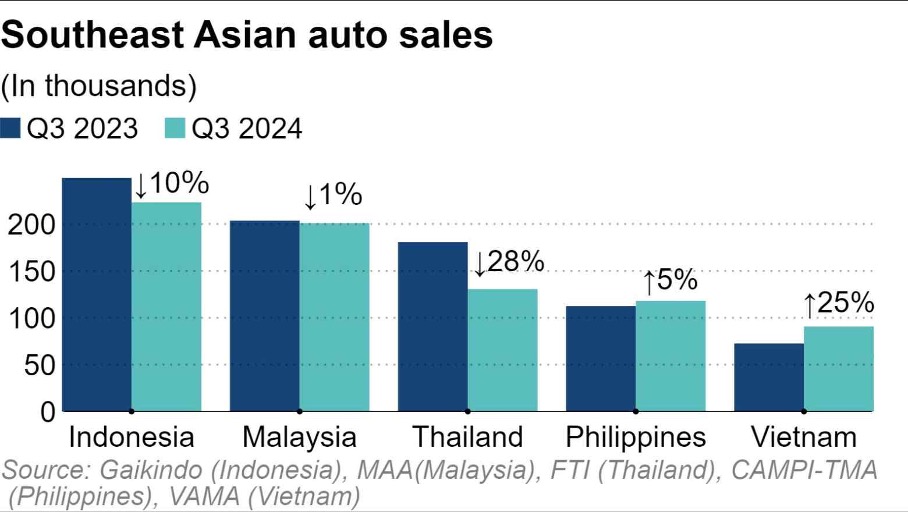

According to Nikkei ASEAN, in Q3 2024, automobile sales across five ASEAN countries — Indonesia, Malaysia, Thailand, the Philippines, and Viet Nam — reached 763,000 vehicles, down 7% compared to the same period last year. Malaysia surpassed Thailand to become the second-largest market, while the gap between Thailand and the Philippines, the fourth-largest market, significantly narrowed.

Market-Specific Growth Dynamics Present Diverse Trends:

(i) Thailand:

From July to September 2024, automobile sales in Thailand experienced a significant decline, contrasting the growth seen in other major Southeast Asian markets. Sales dropped by 28% year-on-year and 9.5% quarter-on-quarter. Experts attribute this trend to high household debt levels leading banks to tighten auto loan conditions. Additionally, continuous price reductions by Chinese electric vehicle (EV) manufacturers have made consumers hesitant, fearing depreciation right after purchase.

(ii) Philippines:

Automobile sales in the Philippines grew by 5% in Q3. Although this growth is slower than the 11% recorded in Q2, analysts view the market outlook positively. This optimism may stem from the country's central bank cutting interest rates in August, boosting consumer confidence.

(iii) Indonesia:

In contrast, Indonesia's automobile sales fell by 10.4% year-on-year in Q3. This marks the 15th consecutive month of decline since July 2023. Anto Jimmi Suwandy, Marketing Director at Toyota Astra Motor, attributed this trend to global economic volatility, inflationary pressures, and domestic political uncertainties influencing consumer purchasing decisions. Analysts predict this downturn will persist through 2024, with annual sales in Indonesia expected to decrease by 10–20% compared to 2023.

(iv) Malaysia:

Malaysia is now the second-largest automobile market in Southeast Asia. In Q3 2024, sales in Malaysia slightly declined by 1% year-on-year. Despite stable domestic economic conditions and robust private consumption growth, the government’s plan to end gasoline subsidies by the end of the year could impact future automobile sales.

(v) Viet Nam:

Viet Nam saw a 25% surge in automobile sales in Q3 2024. This impressive growth is attributed to the government's policy, enacted in August, which reduced vehicle registration fees by 50% for domestically assembled cars over three months (September to November 2024).