Total number of posts 30.

Foreign direct investment (FDI) has long played a vital role in advancing export industries and strategic sectors across ASEAN. within the period of the ASEAN Economic Community Blueprint 2025 (from 2013-2025), the region saw a surge in FDI, particularly in key sectors such as electronics, semiconductors, automotive, and the emerging electric vehicle (EV) ecosystem. These inflows have helped cement ASEAN’s position as a global manufacturing hub. Strengthening supply chain linkages in these industries, coupled with investment in physical and digital infrastructure, has further deepened regional integration. Notably, FDI in electronics and semiconductors has driven industrial growth and the development of regional supply chains.

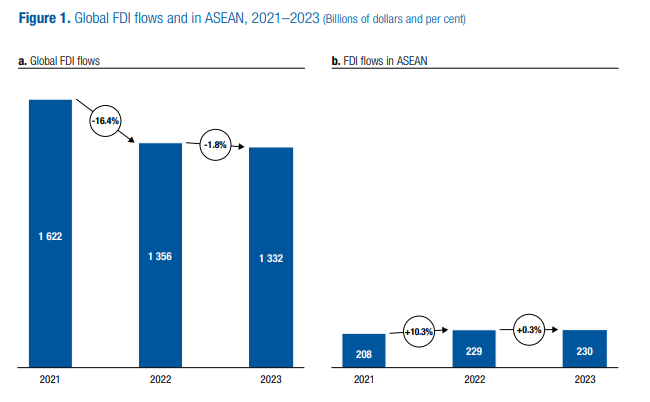

According to the ASEAN Investment Report 2024, recently released by the ASEAN Secretariat, FDI inflows to ASEAN reached a record USD 230 billion in 2023 (Figure 1). While the increase was modest—less than 1 percent—it occurred despite a 10 percent decline in global FDI. This marked the third consecutive year of growth and solidified ASEAN’s position as the leading FDI destination among developing regions, accounting for 17 percent of global inflows, up from 16.5 percent in 2022.

In 2023, five industries accounted for 86 percent of total FDI inflows, which are finance, manufacturing, wholesale and retail trade, real estate, and transportation and storage. Investment in financial activities—including banking, insurance, investment funds, and finance functions of multinational enterprises (MNEs)—jumped by 53 percent to USD 92 billion. Meanwhile, investment in high value-added services, such as professional, scientific, and technical activities (including R&D), rose sharply from USD 0.3 billion to USD 21 billion, supporting industrial upgrading in several Member States.

Greenfield investment announcements in the semiconductor industry averaged USD 5.6 billion annually between 2016 and 2023—more than double the USD 2.2 billion recorded in the period of 2005-2015. Same period comparision, investment in electronic components also rose, from USD 2.5 billion to USD 4.6 billion, with the two sectors together making up nearly 10 percent of total announced greenfield investments. All of the world’s top 25 semiconductor MNEs operate in ASEAN, many with a presence in multiple Member States. Suppliers and contract manufacturers have also continued to invest, reinforcing the region’s interconnected semiconductor ecosystem.

Source: Compiled by the Multilateral Trade Policy Department, Ministry of Industry and Trade of Viet Nam