Summary

Detail

Required documents for imported goods

|

No |

Document name |

Notes |

|

1 |

A customs declaration according to form No. 01 in Appendix II, Circular 39/2018/TT-BTC (If a physical customs declaration is made according to Clause 2 Article 25 of Decree No. 08/2015/ND-CP, which is amended by Clause 12 Article 1 of Decree No. 59/2018/ND-CP, the declarant shall complete and submit 02 original copies of form No. HQ/2015/NK in Appendix IV, Circular 39/2018/TT-BTC) |

Electronic or 02 origin in case of paper declaration |

|

2 |

Commercial invoices or equivalent documents if the buyer has to pay the seller. If the goods owner buys the goods from a seller in Vietnam and is instructed by the seller to receive goods overseas, the customs authority shall accept the invoice issued by the seller in Vietnam to the goods owner. The declarant is not required to submit the commercial invoice in the following cases: b.1) Goods are imported to execute a processing contract with a foreign trader; b.2) Goods are imported without invoices and the buyer is not required to pay the seller. In this case, the declarant shall declare the customs value in accordance with Circular No. 39/2015/TT-BTC dated March 25, 2015 of the Minister of Finance. |

01 photocopy |

|

3 |

The bill of lading or equivalent transport documents if goods are transported by sea, air, railroad, or multi-modal transport as prescribed by law (unless goods are imported through a land checkpoint, goods traded between a free trade zone and the domestic market, imports carried in the luggage upon entry). With regard to imports serving petroleum exploration and extraction transported on service ships (not commercial ships), the cargo manifest shall be submitted instead of the bill of lading; |

01 photocopy |

|

4 |

A statement of imported raw timber (if any) as prescribed by the Ministry of Agriculture and Rural Development |

01 original copy |

|

5 |

The export license or a document permitting the export issued by a competent authority if required by foreign trade law; The quota-based import license or a notification of tariff quota: - If partial shipments are not permitted - If partial shipments are permitted |

01 original copy 01 original copy for the first consignment |

|

6 |

Inspection certificate Note: - If applicable law permits submission of photocopies or does not specify whether the original copy or photocopy has to be submitted, the declarant may submit a photocopy. - If the inspection certificate is used multiple times during its effective period, the declarant shall only submit it 01 time to the Sub-department of Customs where procedures for import of the first consignment are followed |

01 original copy |

|

7 |

The certificate of eligibility to import prescribed by investment law |

01 photocopy while following procedures for import of the first consignment |

|

8 |

The value declaration in Circular 39/2018/TT-BCT

|

Electronic declaration to the e-customs system or submit 02 original copies to the customs authority |

|

9 |

Documents certifying goods origins specified in Circulars of the Minister of Finance on determination of origins of exports and imports |

|

|

10 |

A list of machinery and equipment in case of combine machines or machine sets of Chapters 84, 85 and 90 of Vietnam’s nomenclature of exports and imports or unassembled or disassembled machinery and equipment |

01 photocopy with presentation of the original copy for comparison in case of partial shipments |

|

11 |

Entrustment contract if an import license, inspection certificate or certificate of eligibility to import is required for import entrustment as prescribed by investment law and the trustee uses the license or certificate of the trustor |

01 photocopy |

|

12 |

A contract to sell goods to a school or research institute or a contract to supply goods or services that are imported to serve teaching or scientific experiments and apply 5% VAT according to the Law on Value-added tax |

01 photocopy |

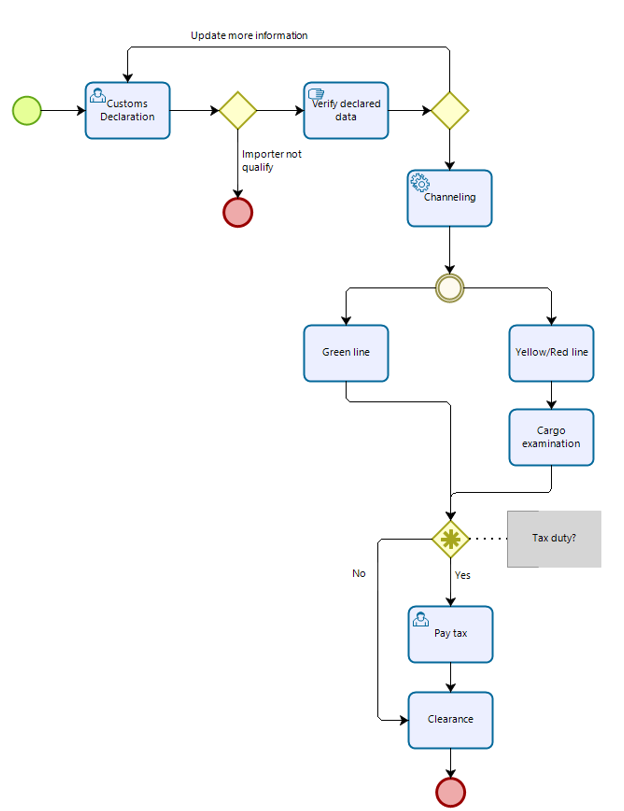

Process steps:

|

Step 1: Customs Declaration Submission |

1.1: Registration Importers must submit customs declaration to Customs System by IDA. Registered information will be stored and can be modified up to 7 days.. |

|

1.2: Information Change In case of changing information from IDA importer has to go through IDB to change information (if any) |

|

|

1.3: Submission of Final Declaration Importer sends final registered custom declaration by IDC |

|

|

Step 2: Receiving feedback from Customs System

|

2.1: Feedback for Green Channel If Customs System sends feedback for Green Channel importer has to pay duty (if any) and get custom clearance. |

|

2.2: Feedback for Yellow Channel If Customs System sends feedback for Yellow Channel importer has to present the required documents for Customs verification |

|

|

2.3: Feedback for Red Channel If Customs System sends feedback for Red Channel importer has to submit the required documents and cargo for physical examination. |

|

| 2.4 Importer pays duty and charge/fee | |

|

Step 3: Receiving Customs Clearance |

Importer receives Customs clearance |

Process workflow: