Total number of posts 463.

Vietnam’s industrial zones (IZs) play a key role in foreign investment as these are locations where most manufacturing takes place. IZs are areas earmarked by the government that have competitive facilities, infrastructure, logistics, and favorable tax incentives.

While IZs differ as per their location, structure, incentives and so on, they offer ideal options for investment, provided investors due their due diligence and chose a suitable IZ location based on their requirements. Companies setting up their manufacturing facilities inside IZs enjoy preferential policies such as corporate income tax exemption and reduction and land rental exemption.

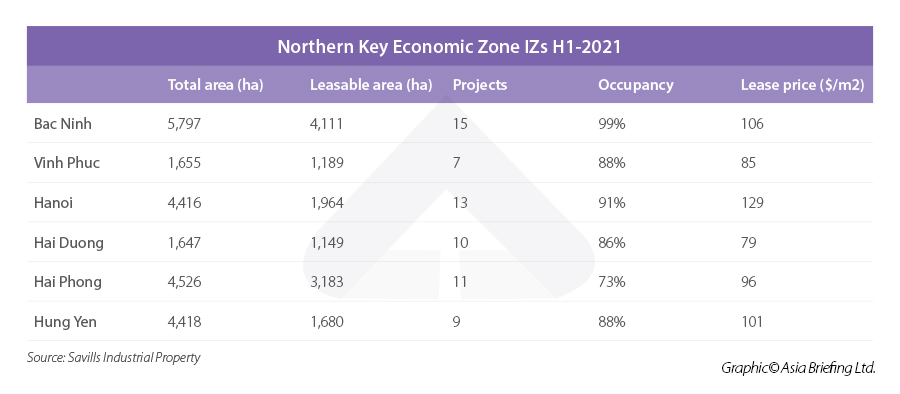

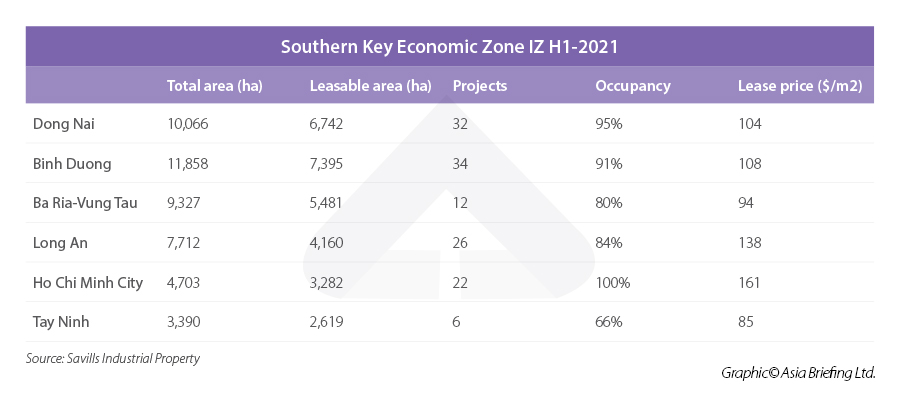

Vietnam’s development means agricultural land has to be converted for industrial and commercial use, which is complex. Most land is in small plots with an average size of around 2,000 to 3,000 square meters owned by private individuals or the government. Vietnam has approximately 369 IZs of which around 284 are in operation. Occupancy rates are high particularly in the South and the North surrounding Hanoi and Ho Chi Minh City. The average IZ occupancy rate is already around 70 percent.

IZs are typically centered around the major cities and economic centers. So, in the North, IZs are located around Hanoi, in the Central region in and around Da Nang, and in the South in and around Ho Chi Minh City. However, as land prices go up and occupancy increases, IZs are being developed outside of economic centers to cater to the rising demand.

Typically, IZs are located around economic centers due to the proximity to major markets. High-density cities also offer a broad market base with large pools of skilled and unskilled labor. In addition, prominent universities and vocational schools are located around such clusters while infrastructure such as airports and ports are the best around bigger cities.

IZs under development

Nevertheless, due to high occupancy rates, investors have to outbid and negotiate with IZs, which can entail risks. While investors can scout locations in less developed areas, another option is shortlisting locations in under development IZs. This allows investors to lock in IZs that are suitable for location, size, availability, and infrastructure. However, this also carries risks as the IZ is not proven and there may be teething issues as the IZ commences operations. Established IZs on the contrary have a proven record and any drawbacks are known and accounted for.

In addition, land acquisition can be complex and even take two to three years. If there are issues, then this may take longer. Vietnam’s regulations are also in flux. The laws on land use including construction are generally revised every five years or so with adjustments common. IZs established when old laws are in effect are subject to those regulations, but when new laws come into effect, such IZs may be subject to new regulations. This can thus have an impact on schedules.

Therefore, it is imperative for investors to do their due diligence on each location. This includes the legal status, compliance, and compensation in regard to the development schedule of the site, particularly for IZs under development.

Other factors to consider include:

- IZ license and whether the legal records are in accordance with Vietnamese law. This includes compliances related to waste emissions, noise, and environmental licenses.

- Pricing: This includes land and factory rent, management fees, electricity and water charges, and so on.

- Infrastructure: This includes roads and infrastructure within the IZ, but also highways, roads, airports, seaports connecting with the IZ with the distance factored in.

- Industries: Some IZs specialize or attract certain industries like manufacturing, IT, automobiles, and so on. Investors should check if the IZ is suited for their line of business. Additionally, choosing a completed IZ and choosing one under development has its own set of advantages and disadvantages that the investor needs to consider.

Choosing to relocate operations to Vietnam will not be without its share of challenges. Manufacturers must plan how to realign their supply chains, which production elements to relocate, and the ideal market entry strategy.

Processes that should be considered during a relocation include:

- Market study;

- Initial screening;

- Preliminary due diligence and long-list locations;

- Detailed due diligence;

- Comparison model development;

- Final site selections; and

- Organizing a visit.

Factory considerations

Another factor that investors should consider is if they will rent an existing factory, rent land and build a factory, use of land use right (LUR) and build a factory, and use of LUR and use an existing factory. Setting up a factory can take time and varies between two to four months or longer.

Some specifics to keep in mind when undertaking the process are a construction permit, fire protection/safety, sector-specific licenses, public announcements, and an environmental impact assessment. Several IZs can take care of this process for you, however, investors are advised to have these reviewed by a third party.

Investors should also keep in mind the factory setup process such as acquiring an investment registration certificate (IRC), the enterprise registration certificate (ERC) also known as the business license, and doubles up as a tax registration number, and post-licensing procedures.

Final considerations when choosing your IZ

It’s important to do your homework, especially regarding regional variations. We advise meeting with multiple IZs as they can vary in quality and incentives.

A comparative matrix assessing localized data points should include labor, land cost, supply chain depth, infrastructure quality, cost of utilities as well as tax and non-financial incentives though this is hardly exhaustive.

Lastly, be ready to negotiate with IZs and have a third party or professional firm review their work, as there have been instances where investors ran into trouble with government authorities due to inadequate licenses and procedures.

Source: Asia Briefing