Summary

Detail

Required documents for export declaration:

|

No |

Document name |

Note |

|

1 |

A customs declaration (form No. 02 in Appendix II , Circular 39/2018/TT-BTC (If a physical customs declaration is made according to Clause 2 Article 25 of Decree No. 08/2015/ND-CP, which is amended by Clause 2 Article 1 of Decree No. 59/2018/ND-CP, the declarant shall complete and submit 02 original copies of form No. HQ/2015/NK in Appendix IV, Cirnular 39/2018/TT-BTC) |

Electronic or 02 origin paper form |

|

2 |

Commercial invoices or equivalent documents if the buyer has to pay the seller |

01 photocopy |

|

3 |

A statement of raw timber for export (if any) as prescribed by the Ministry of Agriculture and Rural Development |

01 bản chính |

|

4 |

The export license or a document permitting the export issued by a foreign trade authority if required: - In case of single shipment: 01 original copy - In case of partial shipments: 01 original copy for the first consignment |

|

|

5 |

A notice of exemption from inspection or inspection result or an equivalent document (hereinafter referred to as “inspection certificate”): - If corresponding regulations of law permits submission of photocopies or does not specify whether the original copy or photocopy has to be submitted, the declarant may submit a photocopy. - If the inspection certificate is used multiple times during its effective period, the declarant shall only submit it 01 time to the Sub-department of Customs where procedures for export of the first consignment are followed |

|

|

6 |

The certificate of eligibility to export prescribed by investment law |

01 photocopy while following procedures for export of the first consignment |

|

7 |

Entrustment contract: 01 photocopy if an export license, inspection certificate or certificate of eligibility to export is required for export entrustment as prescribed by investment law and the trustee uses the license or certificate of the trustor; The declarant is not required to submit the documents mentioned in Point d, Point dd and Point e of this Clause if they are sent electronically by the inspecting authority or regulatory authority through the National Single-window Information Portal in accordance with regulations of law on national single-window system |

01 photocopy |

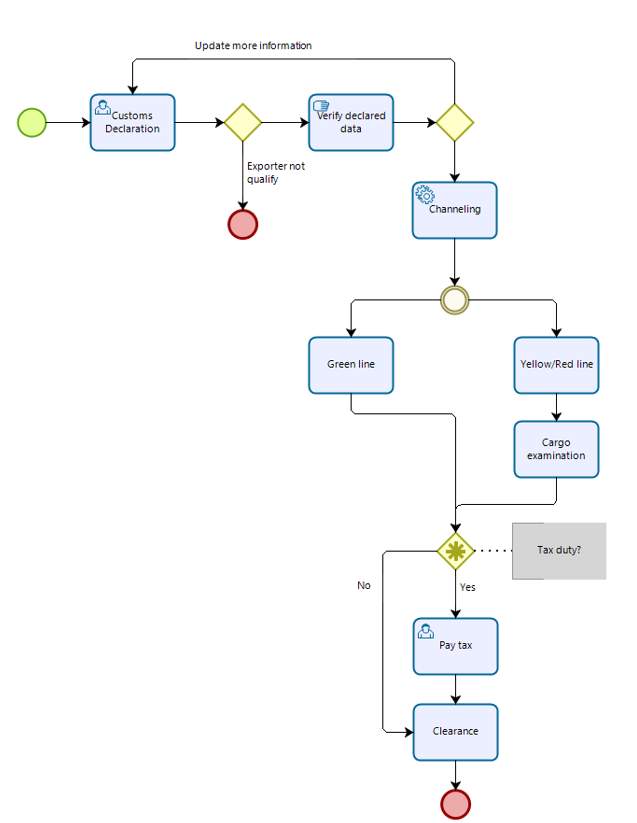

Trình tự thực hiện:

|

Step 1 Customs Declaration Submission |

1.1 Registration The exporter shall submit the customs declaration on the VNACCS System by following the EDA procedure. Registered information will be stored and can be changed/modified up to 07 days. 1.2 Information Change In case of changing information from the EDA, the exporter shall go through the EDB procedure to change the information (if any). 1.3 Submission of Final Declaration The exporter shall submit the final registered customs declaration on the VNACCS System by following the EDC procedure. |

|

Step 2 Feedback from the VNACCS System |

2.1 Feedback for Green Channel If the VNACCS System sends feedback for Green Channel, the importer has to pay duty (if any) and get approval for customs clearance. 2.2 Feedback for Yellow Channel If the VNACCS System sends feedback for Yellow Channel, the exporter has to submit the required documents for customs verification 2.3 Feedback for Red Channel If the VNACCS System sends feedback for Red Channel, the exporter has to submit the above documents and cargo for physical examination. 2.4 Payment of tax/duty and charge/fee by the Importer The exporter gets approval for customs clearance |

|

Step 3 Approval for Customs Clearance |

Clearance |

Process workflow: