Summary

Detail

The analysis for classification of goods is conducted in the following cases:

1. If the customs authorities do not have sufficient basis for determining the accuracy classification of goods of customs declarant, analysis for classification of goods shall be applied.

2. If the customs authorities are not eligible to perform goods analysis, they shall use the assessment service of assessment organizations as prescribed by law on commercial assessment services.

3. To classify goods, the customs declarant may use the goods assessment services of assessment organizations in accordance with law or the database on the list of exported, imported goods of Vietnam to determine the information on the composition, physical, chemical properties, features, use of exported and imported goods.

The classification of goods is based on the principle that one goods item has only a single code under the list of exported - imported goods of Viet nam (also refered to as the Nonmenclature of Viet Nam).

The results of goods classification are used for purposes as below:

1. The results of goods classification shall be used for the application of goods management policies on the basis of implementation of regulations on conditions, procedures, applications applied in the list of goods banned from export and temporarily suspended from export ; List of goods banned from import and temporarily suspended from import; List of exported or imported goods under the license from competent State agencies; List of goods subject to specialized inspection taking effect at the time of registration of the declaration.

2. The results of goods classification shall be used to impose a tariff rate on one article on the basis of implementation of the provisions of tax schedule applicable to exported and imported goods taking effect at the time of registration of declarations and conditions, procedures and application to be applied tariff rates specified in the legal documents on taxes on exported and imported.

Required documents for the goods classification analysis

|

No |

Name of documents |

Remarks |

|

1 |

Application for analysis of import, export commodity and Minutes of commodity specimen collection (Form No. 05/PYCPT/2021 under Circular No. 17/2021/TT-BTC) |

01 set for each commodity |

|

2 |

Records containing number and date of documents affiliated to customs documents relating to commodity specimen. |

|

|

3 |

Specimen of commodity requested for analysis. |

02 pieces. In case the customs declarant only imports 1 specimen, the specimen collection is not required |

|

4 |

Technical documents of commodities |

In case the technical documents are not available, the customs authority shall note about it in the Application. |

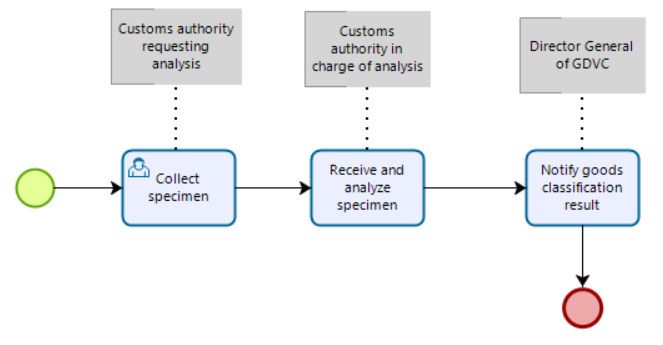

Process Steps

|

Step 1 |

The customs authority collects the specimen for analysis. Specimen shall be collected from the shipment that requires analysis and representing the shipment; must be adequate in terms of quantity and quality to serve expertise or dispute settlement. Specimen collection must be conducted at presence of customs declarants. Specimen must be countersigned by all parties and sealed individually. Specimen transfer must be recorded in written form and countersigned by all parties. |

|

Step 2 |

Customs authority receives the specimen and performs analysis.. The specimen shall be kept within 120 days from the date of issue of Notification of classification results excluding special goods such as easy dangerous goods, degraded goods or goods which cannot be stored be in the above time. |

|

Step 3 |

Declaration of goods classification results Within 5 working days or, in case analysis period depends on analysis technical procedures or in case commodity specimen is complicated, 20 working days from the date on which adequate applications and specimen are received, the Director General of the General Department of Vietnam Customs (GDVC) shall issue the declaration of commodity analysis results. |

Process map

Note

The declaration of goods classification results are implemented as below:

1. Within 5 working days or, in case analysis period depends on analysis technical procedures or in case commodity specimen is complicated, 20 working days from the date on which adequate applications and specimen are received, Director General of Customs Department for Goods Verification shall issue declaration of commodity analysis results (Form No. 08/TBKQPL/2021 attached with Circular No. 17/2021/TT-BTC).

2. In case analysis results of commodity specimen satisfy categories a and c or categories b and c below, Heads of Customs Branch for Goods Verification shall issue declaration of analysis results together with commodity code (Form No. 10/TBKQPTPL/2021 attached with Circular No. 17/2021/TT-BTC) within 5 working days or, in case analysis period depends on analysis technical procedures or in case commodity specimen is complicated, 10 working days from the date on which adequate applications and analysis specimen are received:

a) Commodity name: Name under Declaration for analysis results according to criteria under Vietnamese nomenclature of exports and imports is consistent to conclusion under “Name based on structure and functions” under Declaration for classification result of General Director of General Department of Customs or Director General of Customs Department for Goods Verification.

b) Commodity nature: Type, components and functions of commodities under Declaration for analysis results of are consistent with type, components and functions of commodities under Declaration for classification result issued by General Director of General Department of Customs or Director General of Customs Department for Goods Verification.

c) Commodity code: Refers to code specified under Declaration for classification results issued by General Director of General Department of Customs or Director General of Customs Department for Goods Verification.

3. In case customs authority solicit expertise from expertise institutions, within 5 working days or, in case of complicated commodities, 8 working days from the date on which commodity expertise results are received, Director General of Customs Department for Goods Verification shall issue Declaration for commodity classification results (Form No. 08/TBKQPL/2021 attached with Circular No. 17/2021/TT-BTC).

For commodity specimen whose expertise results fall under circumstances under Clauses 2 of this Article, Declaration for analysis results together with commodity code must be issued within 5 working days from the date on which expertise results are received.

4. Declaration of classification results or Declaration of analysis results together with commodity code shall serve as the basis for determining tax rates and adopting commodity management policies and be updated in database of customs authority, publicized on website of customs authority.

5. In case customs declarants disagree with Declaration for commodity classification results or Declaration for analysis together with commodity code, file complaints according to Law on Complaints or solicit expertise according to Article 30 Decree No. 08/2015/ND-CP dated January 21, 2015 of the Government.