Total number of posts 463.

The European Union (EU) is a large market with the world's leading demand for agricultural imports. The EU market is particularly fond of agricultural products from the tropics. This is an advantage for Vietnam's agricultural exports. From 2018, the EU-Vietnam Free Trade Agreement (EVFTA) with a wide scope and level of commitment is a great opportunity to boost Vietnam's exports. The article focuses on analyzing the characteristics of the EU market, the role of EVFTA and some points to note for Vietnam's agricultural exports to this market.

Lợi thế của Việt Nam là xuất khẩu các sản phẩm từ rau và cây trồng.

EU agricultural market characteristics

The contraction trend in EU agricultural production

Europe is a region with a natural environment with a climate quite favorable for agricultural production, especially arable and livestock farms. It is the world's largest producer of cereals (excluding rice and corn), sugar, fruits, temperate vegetables, meat and dairy products. However, agricultural production in the EU tends to shrink, reflected in the size of labor involved in this sector and the share of agricultural production value in GDP.

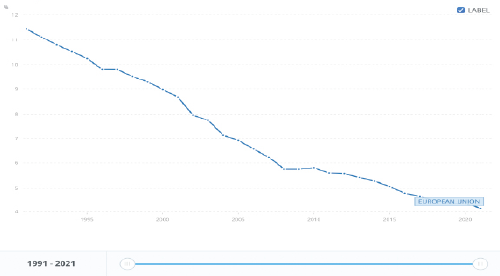

First, the number of people employed in the EU's agricultural sector has long been on a downward trend. According to statistics from the World Labour Organization (ILO), the proportion of workers participating in agricultural production tends to decrease continuously, in 2021, the proportion of workers in the agricultural sector in the total labor force of the EU is just over 4%, equal to 1/3 of 1991.

Figure 1: The proportion of workers in the agricultural sector in the EU

Source: ilostat.ilo.org/data.

Between 2007 and 2022, the average rate of decline in the volume of agricultural labour employed across the EU as a whole was 2.6% per year; The downward trend continues into 2022, although estimated at a slightly slower pace (-1.9%).

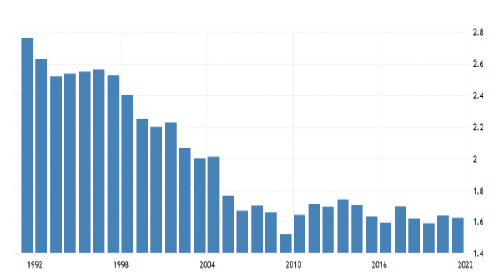

Secondly, although the value of agricultural production still tends to increase, the EU also implements many policies to support agricultural production, however, the trend of reducing the proportion of agricultural production value in GDP is partly due to the increase in input costs of goods and services.

The share of agricultural production value in GDP also tends to shrink. In 1991, the value of agricultural production reached 2.7% of GDP, this share fell to 1.8% of GDP in 2015, and today agriculture contributes more than 1.6% of the EU's GDP.

Figure 2: Contribution of the agricultural sector to GDP in the EU.

Source: Trading Econonomics Database

More than half of the value of EU agricultural production comes from farming

In the structure of agricultural production, 53.5% of the total output value of the EU agricultural sector in 2022 came from crops (EUR 287.3 billion), of which cereals, vegetables and horticultural crops are the most valuable crops. Almost two-fifths (38.5%) of total production comes from animals and animal products (EUR 206.7 billion), with the majority coming from milk and pigs. Agricultural services (EUR 23 billion) and integral non-agricultural activities (EUR 19.8 billion) contributed to the rest (8%).

EU import demand for agricultural products increases continuously

According to the EU statistics agency Eurostat, of the countries exporting fruits and vegetables to Europe, as many as 70 are developing. The countries that import the most tropical fruits and vegetables in Europe are the Netherlands, Germany, the United Kingdom and France. Tropical fruits and spices and products are popular on the European market. The rather harsh climatic conditions in Europe greatly hindered their cultivation.

Therefore, EU countries import quite a lot of fruits such as bananas, oranges, tangerines, mangoes, pineapples. The top EU importers are Germany, the UK, France and the Netherlands, accounting for more than 70% of the EU's fruit and vegetable imports. Within the EU, the UK is the largest consumer market, followed by France and Germany. Demand for fresh tropical fruits in the EU is forecast to increase by 6-8% annually.

Increasingly stringent quality requirements for imported agricultural products

In general, standards for agricultural products, especially foodstuffs that can be circulated on the European market in general, are very detailed, rigorous and adjusted to the requirements of society, the development trend of science and technology, and changes in the way of consumption of European people. The EU market is very competitive, so imported goods must ensure high quality, eye-catching packaging designs, products must ensure consumer health and environmental safety.

For imported agricultural products, the EU market requires a certificate of origin (C/O), with an ecological label (C/E), meeting the critical limit control point (HACCP) standard to help identify, assess and control hazards affecting food safety.

In EC Decree No. 2073/2005 on microbial standards for food, article 5 requires: for sampling and analysis of samples, sampling must refer to ISO 18593. EC Regulation No. 1774/2002 on compost and soil improvers prohibits the use of compost and soil improvers on grassland. The new restrictions also pay special attention to the needs of the most vulnerable groups such as infants and children.

In addition, the EU market also pays great attention to the reputation of enterprises supplying imported goods, especially the responsibility of enterprises to society and the environment. According to this criterion, enterprises exporting to the EU market must often be those that are interested in using renewable materials, saving energy, improving water resources, caring about relief and community work, applying standards to employees and business partners.

Partners of the EU market

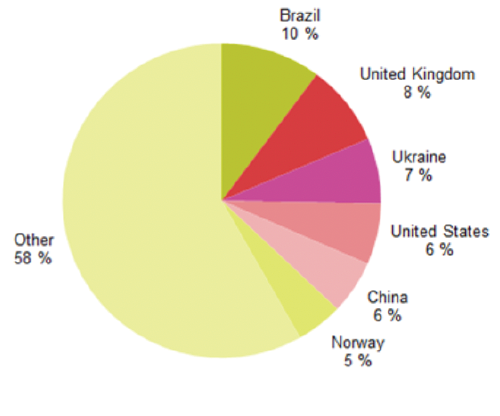

With the need to import more than 150 million tons of agricultural products per year, the partner exports agricultural products to the EU spread across continents. In recent years, Brazil, the UK and Ukraine have been the largest suppliers of agricultural products to the EU market, accounting for 10%, 8% and 7% of total imports respectively. Next are the US and China with a share of 6% of total imports.

Figure 3: EU agricultural imports – by partner, 2022.Source. Eurostat

In the ASEAN region, Indonesia is the leading country in exporting agricultural products in general to the EU market. It is also the largest exporter of oils and fats to the EU, meeting 16% of the EU's total oil and fat imports. Vietnam and Thailand are also 2 partners with significant export capacity for the EU market. In particular, Vietnam's advantage is the export of vegetable and crop products and animal products. In 2022, in the category of vegetables, Vietnam is the 3rd largest import partner of the EU, meeting 4% of the region's vegetable import demand – on par with China and Australia, behind Brazil, the US and Ukraine.

In addition, the EU tends to expand trade for agricultural products imported from the ASEAN region, this is an opportunity for Vietnamese agricultural exporters to continue promoting their product export activities to the EU market.

EU-Vietnam Free Trade Agreement (EVFTA)

The EU-Vietnam Free Trade Agreement (EVFTA) is a new generation FTA between Vietnam and 27 EU member countries. EVFTA and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) are two FTAs with a wide scope of commitments and the highest level of commitment of Vietnam ever. For EVFTA, due to the completion of ratification procedures, this Agreement has officially entered into force from August 1, 8.

EVFTA consists of 17 chapters, 2 protocols and a number of accompanying memorandums of understanding. The main contents of the Agreement include: trade in goods, trade in services, rules of origin, customs and trade facilitation, food hygiene and safety measures and phytosanitary (SPS), technical barriers to trade (TBT), investment, trade remedies, etc competition, intellectual property (including geographical indications), sustainable development, legal issues, cooperation and capacity building.

Some issues for Vietnam's exports from EVFTA

Since EVFTA came into effect on August 1, 2020, about 85.6% of tariff lines have been completely eliminated for Vietnamese goods. This rate accounts for 70.3% of Vietnam's total export turnover to the EU. The gradual elimination of such import duties has facilitated Vietnam's exports to the EU to increase by 20% per year.

The Center for WTO and Integration under the Vietnam Confederation of Trade and Industry (VCCI) also said that in the first 2 years of EVFTA implementation, Vietnam's export turnover to 27 EU member countries reached an average of 41.7 billion USD/year, 24% higher than the average figure of 33.5 billion USD in the period 2016-2019. This means that many exporters in Vietnam have benefited from tariff reductions from the EVFTA. The World Bank (WB) estimates that just enjoying the agreed tariff cuts, the EVFTA can boost Vietnam's GDP and exports by 2.4% and 12% respectively by 2030, and help an additional 100,000-800,000 people escape poverty by 2030.

Although the EVFTA brings many export opportunities to Vietnam, it should be noted that the EU is a market with strict consumer protection policies with huge technical barriers for imported products. Some points to pay attention to from EVFTA, which is highly risky, easily leading to trade disputes during the implementation process, that Vietnam needs to pay attention to include:

- Difficulties in ensuring EVFTA's Rules of Origin: The EVFTA Agreement aims to eliminate import duties up to 99.2% of tariff lines. However, to enjoy this preferential rate, exports to the EU need to satisfy rules of origin, which may be a hindrance for Vietnamese exports because raw materials for Vietnam's exports are currently mainly imported from China and ASEAN. If the rules of origin are not guaranteed, Vietnam's exports to the EU are only entitled to the most favored nation (MFN) preferential tax rate, not the 0% tax rate in EVFTA. Most recently, on 23/10/2017, the European Commission (EC) issued a "yellow card" warning for Vietnamese fishing products exported to the European market through information and evidence of illegal fishing activities - poaching by Vietnamese fishing vessels abroad and all issued warnings for these unauthorized activities. The reasons leading to the EC withdrawing the IUU yellow card for Vietnam's seafood industry are: Vietnam still lacks a complete, complete and uniform system of institutions and regulations to manage fishing activities at sea today; Vietnam's maritime fishing fleet has not met the standards and conditions for participating in exploitation at sea; There is a lack of a system to confirm the origin of seafood caught at sea, leading to the majority of seafood caught by fishermen is of unknown origin; especially, Vietnamese fishermen exploit and poach seafood in other countries' waters.

- Issues of intellectual property, labor and environment from EVFTA: Regarding intellectual property: While Vietnam is still quite indifferent to intellectual property issues, this is a top requirement of EU investors. Even higher requirements for intellectual property protection of EU investors than requirements for intellectual property rights in the WTO. The existences related to intellectual property issues in practice can be easily identified in the following 2 specific aspects:

First, regulations on intellectual property rights in Vietnam are still at odds with the EVFTA. There are currently 4 commitments that Vietnamese law has not complied with, including: The exclusive right to announce to the public of performers, producers of sound and video recordings; Procedures and methods of protection for the 169 EU geographical indications listed in the EVFTA; Commit to compensate for pharmaceutical patent deadlines for delays in marketing authorization; and Principles of speculation about the rights of persons named on the work.

Second, the enforcement of intellectual property rights in Vietnam is still lax. In our country, although there are regulations on the enforcement of intellectual property rights, the enforcement of the protection of geographical indications in particular and the management of the use and labeling of origin are not really effective. Almost only administrative measures were applied primarily. The effectiveness of administrative measures is also relatively limited, while civil remedies at the request of stakeholders as well as enforcement related to food origin are also very limited.

On the issue of employers: Despite many efforts, in Vietnamese enterprises, mainly SMEs - there are still obstacles when applying labor standards. Common problems involve employees working overtime beyond the allotted number of hours; regulations on week breaks and public holidays; working environment, occupational hygiene and safety; the right to participate in social insurance, full health insurance, the right to support female employees at work and raise children...

Environmental protection: Up to now, Vietnam has no experience in implementing environmental obligations within the framework of trade constraints and adjustments. Currently, resources for environmental protection activities are still limited, the awareness and capacity of managers as well as people are not high, leading to the serious implementation of environment-related obligations committed in FTAs, posing significant challenges for Vietnam.

- Technical barriers from the EU: EVFTA will bring many opportunities for Vietnam's exports. However, entering the EU market is still not easy because the non-tariff barriers of the EU market are very strict. Typically, agricultural products and foodstuffs must comply with many standards specified in the Law on Food, the Law on Veterinary Health, regulations on consumer health protection, regulations on toxic substances, antibiotic residues, pesticide residues ... Some agricultural products of our country such as tea, vegetables .. There are still limitations due to pesticide residues, lack of uniformity in each shipment, poor harvest preservation, so the quality is limited.

In addition to pure product quality, labor use and environmental factors, as above, the EU also pays great attention to other related factors such as the environmental friendliness of products, corporate social responsibility, etc. According to one estimate, the cost of fully complying with existing non-tariff measures in Vietnam will be equivalent to a tariff rate of 16.6% (compared to the regional average of 5.4%).

Conclusion

EVFTA with its wide scope and level of commitment is a great opportunity to boost Vietnam's exports in the field of agricultural products in particular and exports in general. However, as a fastidious market with very strict regulations on food safety and environmental protection, in order to exploit export advantages, Vietnam needs to focus on synchronous solutions from macro to enterprises, constantly improve production processes, standardize and comply with quality assurance requirements as well as improve awareness and understanding of businesses and employees.

Financial Journal