Total number of posts 0.

| Title | Date |

|---|

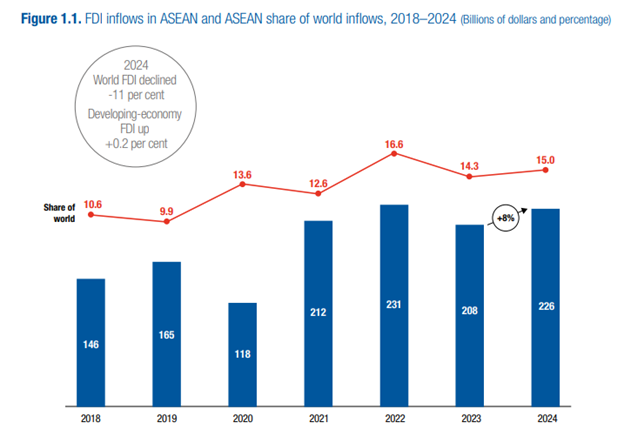

According to the ASEAN Investment Report (AIR) 2025, launched at the ASEAN Business and Investment Summit (ABIS) 2025 held in October 2025 in Kuala Lumpur, Malaysia, foreign direct investment (FDI) inflows into ASEAN reached US$226 billion in 2024, marking an 8% increase from 2023 despite an 11% decline in global FDI flows. This marks the fourth consecutive year that ASEAN has remained the largest FDI recipient among developing regions, reaffirming its position as a leading destination for investment in manufacturing, financial services, and the digital economy.

Notably, intra-ASEAN investment surged by 45% from 2023, accounting for 14% of total FDI in the region. This reflects the region’s growing economic integration and deepening connectivity among ASEAN Member States. The largest extra-ASEAN investment sources were East Asia (around 30%), followed by the United States and the European Union.

Meanwhile, supply chain–intensive industries such as electronics, electrical equipment, automotive, machinery, and apparel continued to attract the bulk of new investments, accounting for nearly 40% of total greenfield investment. The electronics sector alone represented 27% of total FDI, nearly double the global average.

The report also highlighted that Cambodia, Singapore, and Viet Nam recorded the highest FDI inflows in 2024. Green and digital investment projects are also rising rapidly, reflecting ASEAN’s ongoing shift toward sustainable growth and digital transformation.

Despite the challenging global trade and economic outlook in 2025, ASEAN remains well-positioned as a dynamic, resilient, and adaptive global hub for manufacturing and supply chains, underpinning the region’s long-term competitiveness and integration.

|

Viet Nam’s FDI in 2024 rose by 9 per cent to an all-time high, exceeding $20 billion for the first time, supported by robust investment from companies in Singapore, the Republic of Korea and China, in that order. Manufacturing, the largest recipient sector, continued to receive strong attention from investors followed by real estate, reflecting robust economic growth and rising local demand. |

Total number of posts 0.

| Title | Date |

|---|

Ministry of Industry and Trade

Disclaimer: All information on this website is presented for consulation purpose only and does not constitute legal advice. All legal responsibility rests solely on the user. Users should not act upon any information obtained through this website without prior verigication with competent national authorities.

The website has been developed under Web Content Accessibility Guidlines (WCAG) 2

Viet Nam Ministry of Industry and Trade. All rights reserved.

Did you find what you were looking for?

Can we ask you a few more questions to help improve the VNTR?

0 of 12 answered