Total number of posts 463.

According to HSBC Global Research, ASEAN has not only maintained its impressive growth momentum but is also forecast to become one of the fastest growing economic blocs in the world in the next 5 years, with an average growth rate of 4.7%.

This assessment was made by HSBC through the ASEAN Perspectives report - Bigger, better with more to come. The report also affirmed that ASEAN's economic growth journey is an amazing story.

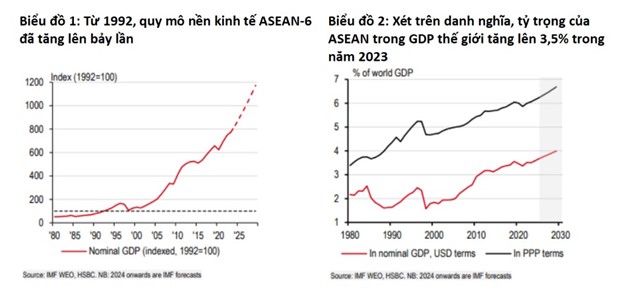

From an economy with a scale of 473 billion USD in 1992, ASEAN has grown strongly and reached 3.63 trillion USD in 2023. The proportion of this region in global GDP has increased from 1.9% to 3.5% in the same period. In particular, HSBC cited IMF forecasts that ASEAN has the potential to increase its share of global GDP to 4% by 2029, with an average growth rate of 4.7% in the 2024-2029 period.

The report also pointed out that for investors looking for dynamism, Southeast Asia is the destination as ASEAN occupies an increasing market share in many economic activities in the world, with each ASEAN economy leading in at least one segment. In particular:

Impressive manufacturing and exports

Manufacturing and exports are the two main drivers of ASEAN's economic development. Since 1992, ASEAN countries have continuously removed intra-bloc trade barriers, turning the region into a virtually borderless market. The CEPT Agreement (1992) and the ASEAN Trade in Goods Agreement (2009) have created a solid foundation to promote free trade.

Other economies in the world are also not willing to stay out of the game. From 2005 to 2010, ASEAN as a whole entered into free trade agreements with China, South Korea, Japan, Australia and New Zealand. The culmination of these agreements was the Regional Comprehensive Economic Partnership (RCEP).

While global trade has been trending inward and protectionism has been on the rise, ASEAN has gone in the opposite direction. The bloc has continued to leverage free trade to import key inputs at competitive prices, transform them into higher-value goods and then sell them to a larger market. This strategy has paid off as ASEAN has increased its share of global merchandise exports from 6.1% in 2005 to 7.4% in 2023, surpassing Japan and South Korea combined and even coming close to surpassing the United States.

Global trade tensions, especially between the United States and China, have also contributed to ASEAN's leading position in attracting foreign direct investment.

Despite global trends, HSBC believes that ASEAN will continue to expand its reach. This openness will be the main strength of the ASEAN economy over the next five years. According to the IMF's World Economic Outlook, ASEAN's imports and exports will be among the fastest growing in the world in the period 2024 - 2029, making the region a role model for trade.

Tourism growth is booming

In recent years, ASEAN has shifted from a region focused on manufacturing to a strong service sector.

Tourism, one of its key industries, continues to grow rapidly. From 2007 to 2019, total tourist arrivals to ASEAN-6 increased by an average of 7.1% per year, and ASEAN's global tourism market share increased from 4.9% to 8.7%.

However, ASEAN's share of tourist arrivals has declined during the pandemic and beyond as Chinese tourists have yet to fully return. The solution to kick-start the recovery phase is to extend the visa exemption scheme to countries outside ASEAN, starting with Malaysia, Thailand and Singapore.

The biggest obstacle for ASEAN is how to add value to tourism. Options include investing in luxury tourism, expanding the culinary scene or hosting mega-events and music shows.

According to HSBC analysis, similar to international tourist arrivals, ASEAN's share of global tourism revenue has also increased between 2007 and 2019. However, if comparing ASEAN's share of global arrivals and its share of global tourism revenue, both indicators have increased at the same rate. This can be understood as meaning that tourism revenue has increased mainly due to increased tourist arrivals rather than increased spending per capita.

To make its mark on the international stage, ASEAN will need to offer more types of tourism activities such as new destinations, MICE (meetings, incentives, conferences, exhibitions) and luxury services.

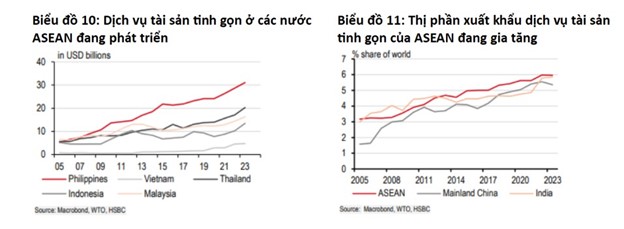

“Lean asset” services reach out to the international market

“Lean asset” services are services that do not require much physical capital, such as aircraft in tourism or chartering ships in freight transport. In most cases, these services are performed in the electronics, telecommunications, finance or arts sectors, such as business process outsourcing, finance, cinema, consulting and the like.

ASEAN has increased its global market share of these services from 3.2% in 2005 to 6% today. These services not only bring high economic value but also help ASEAN affirm its position in the international market.

"With its growing share of lean asset services, we believe ASEAN, like India, is well-positioned to ride the wave of global services exports. ASEAN has created a number of world-class brands and names," HSBC said, citing Singapore's Trip.com, which is making its mark in the digital travel services space. Indonesia-based Gojek offers a multi-service e-commerce and digital payments platform.

Meanwhile, Thailand has lit up the global art scene with award-winning films like "The Legacy of Foreigners" and produced pop stars like Lisa Manoban. And the Philippines has entered the global rap scene with artist Ez Mil.

Economic size expected to surpass Japan by 2029

HSBC's report said that ASEAN - the world's 11th largest economy in 2005, has risen to the 5th position by 2023. According to the IMF's World Economic Outlook, the region is expected to grow at an average rate of 4.7% in the period 2024-2029, making ASEAN the fastest growing economic bloc in the world. Notably, in Asia, ASEAN's growth is only behind India and Bangladesh.

At this rate, ASEAN will surpass Japan in economic size by 2029. While the breadth of ASEAN's growth is unquestionable, another factor makes the region even more impressive.

According to HSBC experts, ASEAN's growth is not only about scale but also about quality. As ASEAN’s share of the global population declines, the region is still growing its economic value through innovation and productivity. Singapore leads the way, ranking fourth in the Global Innovation Index, while countries such as Vietnam and Indonesia have also made impressive progress. ASEAN has also increased its share of global high-tech exports, competing directly with developed economies such as China. Countries such as Singapore and Malaysia have seized opportunities in chip manufacturing and high-tech equipment, helping to raise the profile of the entire region.

As uncertainty clouds global trade, HSBC believes ASEAN will continue to be a haven for free trade. “We therefore believe that ASEAN, with its core of intra-regional free trade, will remain resilient and continue to grow in size and influence,” the HSBC report concluded.